The first thing investors consider when discussing a stock is whether the stock is cheap or expensive: the Price-to-Earnings (P/E) Ratio. It is among the most popular tools of financial analysis to value companies and compare opportunities of investment.

What Is the Price-to-Earnings(P/E) Ratio?

Price-to-Earnings(P/E) ratio indicates the amount that investors are prepared to spend nowadays on every dollar that a firm is earning. It actually shows how much investors are willing to pay today for a company’s earnings.

It’s calculated as:

- Market Price per Share (P): The current trading price of one share.

- Earnings per Share (EPS): The company’s net profit divided by the total number of outstanding shares.

In simple words:

If a stock has a P/E of 20, it means investors are willing to pay $20 for every $1 the company earns.

Why Is the P/E Ratio Important?

- It helps in measuring the valuation of a business: It indicates whether a stock is over-priced, under-priced, or fairly priced.

- Easy Comparison: Investors make comparisons between the P/E ratios of companies operating in the same sector.

- Growth Expectation: When P/E is high, it is a sign that investors anticipate high growth in the future.

- Profitability Insight: It demonstrates the efficiency of a company in generating profit through its operations.

Types of Price-to-Earnings(P/E) Ratios

P/E ratios are mainly of three kinds, including Trailing P/E, Forward P/E, and Justified P/E.

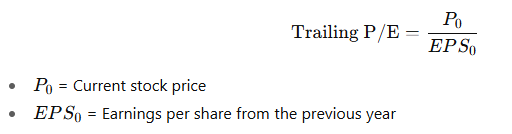

Trailing P/E Ratio (Based on Past Earnings)

Definition:

The trailing P/E involves the historical earnings of the company (historical EPS) of the preceding 12 months.

Example:

If a company’s share price is $100 and its last year’s EPS was $5,

That means investors are paying 20 times last year’s earnings.

Interpretation:

- A high trailing P/E may indicate optimism or overvaluation.

- A low trailing P/E may indicate undervaluation or declining performance.

Forward P/E Ratio (Based on Expected Earnings)

The forward P/E relies on the future earnings (anticipated EPS in the coming year).

Example:

If a company’s share price is $100 and next year’s expected EPS is $6,

This shows the stock looks cheaper based on future earnings growth.

Interpretation: Forward P/E assists investors in knowing the expectations of the market concerning the performance of the company in the future.

Justified P/E Ratio (Based on Fundamentals)

The Justified P/E Ratio indicates the value of the P/E ratio, which should be according to the financial fundamentals of a company its growth rate (g), its payout ratio, and its required rate of return (r).

Justified P/E Ratio is based on the Gordon Growth Model, which is a correlation between stock value and growth, and expected dividends.

Formula for Justified P/E Ratio:

There are two versions:

- Justified Forward P/E:

- Justified Trailing P/E:

Where:

- r = Required rate of return (investor’s expected return)

- g = Dividend or earnings growth rate

- Payout ratio = Dividend ÷ Earnings

Step-by-Step: How to Calculate the Justified P/E Ratio

Let’s walk through an example:

Example:

For FPL Group Inc. (FPL), an analyst gives the following forecasts:

- Dividend payout ratio = 50% (0.5)

- Growth rate, g = 5%

- Required rate of return, r = 9%

Step 1: Identify the formula

Use the Justified Forward P/E formula:

Step 2: Plug in the values

Step 3: Solve

Step 4: Find the Justified Trailing P/E

Final Answer:

- Justified Forward P/E = 12.5

- Justified Trailing P/E = 13.13

Interpreting the Justified P/E Ratio

- A higher justified P/E suggests strong growth prospects and low risk.

- A lower justified P/E suggests slower growth or higher risk.

- Comparing the actual P/E to the justified P/E helps investors decide if a stock is overvalued or undervalued.

Quick Comparison Table

| Type of P/E | Basis | Formula | Purpose |

|---|---|---|---|

| Trailing P/E | Past EPS | ( P_0 / EPS_0 ) | Shows historical valuation |

| Forward P/E | Future EPS | ( P_0 / EPS_1 ) | Shows expected valuation |

| Justified P/E | Fundamentals | (Payout) / (r – g) | Shows fair valuation based on growth and return |

Final Thoughts

Price-to-Earnings(P/E) ratio is a foundation of stock valuation. With knowledge on Trailing, Forward, and Justified P/E, investors will make more informed decisions not necessarily by the market prices, but by the actual financial fundamentals.

A company that has a stable payout policy, good growth rate, and an affordable cost of equity will tend to have a higher justified P/E, which will indicate long-term investor confidence.