When we talk about the movement of stock prices or asset values in finance, we often use a mathematical model to describe their behavior. One of the most important models in this field is the lognormal distribution. But what exactly is it, why do we use it, and how does it work? Let’s break it down in easy words.

What Is a Lognormal Distribution?

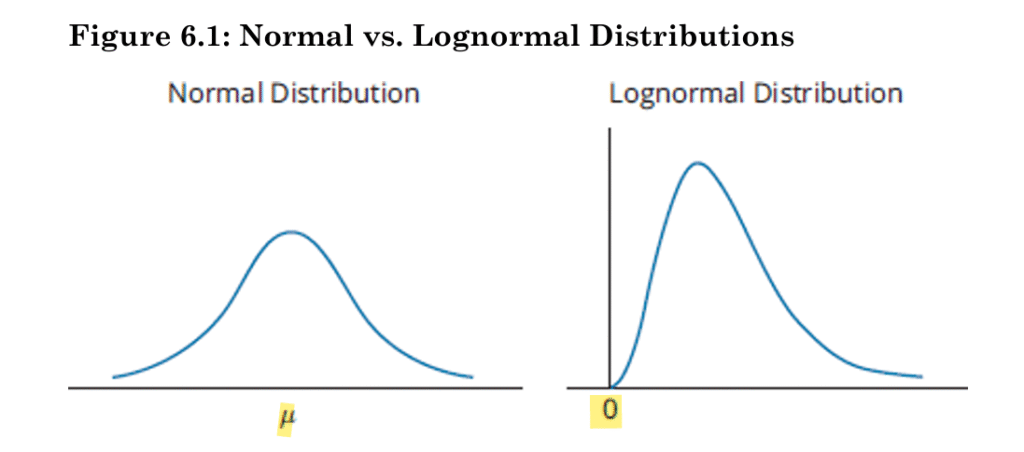

A lognormal distribution is a type of probability distribution where the logarithm of the variable is normally distributed.

In simple terms:

- If returns (growth rates) follow a normal distribution (bell curve),

- Then asset prices follow a lognormal distribution.

This happens because prices can never be negative — a stock cannot trade at –$50. Instead, prices start at zero and extend infinitely upward, which is exactly how a lognormal distribution looks.

Normal vs. Lognormal Distribution

- Normal Distribution: Symmetrical bell curve centered around the mean. It allows for both positive and negative values. For example, daily returns of a stock could be +3% one day and –2% the next.

- Lognormal Distribution: A Skewed curve that starts at 0 and stretches to the right. It only allows positive values. This makes it perfect for modeling prices, which can rise or fall, but never fall below zero.

Key takeaway: Returns are modeled as normal, while prices are modeled as lognormal.

Why Do We Use Lognormal Distribution in Finance?

The lognormal distribution is crucial because it fits the real behavior of asset prices:

- Prices can’t be negative – The lognormal distribution reflects this reality.

- Prices grow over time – Whether slowly or rapidly, asset prices generally drift upward with volatility.

- Captures skewness – Unlike a perfect bell curve, the lognormal distribution shows the right-skewed behavior of prices (large upward moves are possible, but not negative beyond zero).

In essence, lognormal models give us a realistic picture of how prices evolve in the market.

The Role of Continuous Compounding

Finance often uses continuously compounded returns, because they are:

- Easy to add up across time.

- Naturally linked to exponential growth.

The formula for price in terms of continuous returns is:

Example of Continuous Compounding

Let’s say:

- Current price (P0) = 100

- Continuously compounded return = 5% per year

- Time = 3 years

So after 3 years, the stock price grows to about 116.18.

If we used annual compounding instead, we’d get 115.76 — slightly lower. That small difference comes from the fact that continuous compounding accounts for growth at every instant.

Key Properties of Lognormal Distribution

- Always positive: No chance of negative prices.

- Right-skewed: The tail on the right is longer, reflecting the possibility of very large price increases.

- Mean > Median > Mode: Because of the skewness, the average price will always be greater than the middle (median).

Why This Matters for Investors and Analysts

For CFA candidates and finance professionals, understanding the lognormal distribution is crucial. It underpins many pricing models, risk management tools, and valuation techniques. It ensures that the models reflect real-world constraints — that prices stay non-negative and capture realistic growth dynamics.

Final Thoughts

The lognormal distribution is more than just a mathematical concept — it’s the foundation of how we understand asset price movements. By linking normal distributions (returns) to lognormal distributions (prices), finance professionals can model markets realistically, manage risks effectively, and make better investment decisions.