When it comes to investing, one of the biggest questions every investor faces is: What is this business really worth?

Most people look at book value (assets minus liabilities) or simply rely on discounted cash flow (DCF) models. But there’s another powerful approach that combines accounting information with the idea of excess profitability — the Residual Earnings Model.

In this article, we’ll break down the concept step by step, explain why it matters, and show how it connects to valuation methods like P/B ratios and DCF.

What are Residual Earnings?

Investors don’t give money for free. If they give a firm 400 today, they require a return, say 10%. That “required return” is like rent on the money.

- Required return in dollars = 10% × 400 = 40.

- If the project earns exactly 40, investors just got their rent. No extra value was created.

- If it earns more than 40, the extra is value created.

Those “extra earnings” are called residual earnings (also: residual income, abnormal earnings, excess profit).

Formula for Residual Earnings

Residual earnings = Actual accounting earnings − Required return (in dollars).

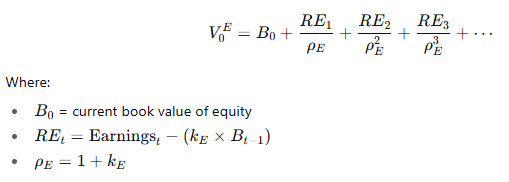

The Residual Earnings Valuation Formula

The intrinsic value of a business (or project) under this model is:

Value = Book Value + Present Value of Expected Residual Earnings

- Book value = Assets − Liabilities (what is already on the balance sheet).

- Present Value of Residual Earnings = Discounted value of future “excess” earnings (profits above investors’ required return).

This approach ensures that book value serves as the foundation, and only extra profitability creates a premium above book value.

A Simple Example

Assume some numbers:

- Beginning book value B0 = 100

- Required return, kE = 10% , ρE = (1+0.10) = 1.10

- Forecast earnings:

- Year 1 = 15

- Year 2 = 16

- Year 3 = 13

After Year 3, assume no extra value (the firm earns exactly the required return).

Calculate residual earnings (RE)

- Year 1:

RE_1 = 15 − (0.10 × 100) = 15−10 = 5

New book value B1 = 100 + 15 = 115 - Year 2:

RE_2 = 16 − (0.10 × 115) = 16

New book value B2 = 115 + 16 = 131 - Year 3:

RE_3 = 13 – (0.10 × 131 ) = 13 − 13.1 = −0.1

New book value B3 = 131 + 13 = 144

Discount residual earning

Add to beginning book value

V0_E =100 + (4.55 + 3.72 − 0.075) = 100 + 8.20 = 108.20

The intrinsic value of equity today is 108.2.

Since book value was 100, this firm is worth about 8% more than book value because it generates positive residual earnings in Years 1–2.

Why the Residual Earnings Model Matters

- Connects Book Value and Profitability

Book value gives you the foundation. Residual earnings tell you if management is creating or destroying value beyond that foundation. - Explains Price-to-Book Ratios (P/B)

- If Return on Equity (ROE) ≈ Required Return → P/B ≈ 1

- If ROE > Required Return → P/B > 1 (premium over book)

- If ROE < Required Return → P/B < 1 (discount to book)

- Prevents Overpaying for Earnings

Just because a firm shows profits doesn’t mean it’s creating value. The profits must exceed the cost of capital. Residual earnings highlight this difference clearly.

Key Takeaways

- Residual earnings = Earnings − Required return on book value.

- If residual earnings are zero → Value = Book value.

- If residual earnings are positive → Value > Book value (value is created).

- If residual earnings are negative → Value < Book value (value is destroyed).

- The Residual Earnings Model = A valuation method that complements and reinforces DCF.

Final Thoughts

Valuation is at the heart of smart investing. The Residual Earnings Valuation reminds us that not all profits are created equal. What truly matters is whether a company generates returns above the required return that investors demand.

By anchoring on book value and adding only the present value of residual earnings, this model gives investors a practical, accounting-based way to measure intrinsic value — and avoid paying too much for mere “expected” earnings.