In this article, we’ll dive deep into these foundational principles of finance, discussing how intrinsic values and stock prices are formed, what factors influence them, and why creating long-term value should be every company’s main objective.

In the world of finance, understanding the concepts of intrinsic value and stock prices is crucial for investors, managers, and anyone involved in public corporations. The primary goal of public companies is to create value for their shareholders, but achieving this requires insight into what determines a company’s true worth beyond its current market price.

Note that, the idea of this article and the image, has been taken from the book “Fundamentals of Financial Management“ by Brigham Houston.

What is the main financial goal of public companies?

The Core Financial Goal: Creating Sustainable Value for Investors

At the heart of every public company’s mission is the goal of creating value for investors. Managers and employees work on behalf of the shareholders who own shares in the company, meaning their primary obligation is to pursue strategies that maximize shareholder wealth. This approach to business isn’t just about short-term gains; it focuses on long-term financial health and sustainable growth, ensuring that companies generate wealth that lasts.

While companies may often highlight metrics like growth, earnings per share (EPS), and market share, these are only part of the picture. However, the ultimate financial goal of public companies is to create sustainable value for investors. Stockholders aren’t just abstract entities; they represent real people and organizations who have chosen to invest their hard-earned money in the company. These investors are looking for a return that will help them reach important financial goals, such as retirement savings, buying a home, or funding education.

So, how does a company can maximize shareholders’ value?

To truly maximize stockholder value, companies need to prioritize long-term financial goals over immediate profit. A company’s stock price reflects the present value of all future cash flows it expects to generate, rather than just current earnings. This focus on long-term financial health requires management to make strategic decisions that might temporarily sacrifice short-term profits but ultimately lead to long-term success.

By understanding the difference between short-term gains and long-term value creation, managers can help keep the company’s stock price closer to its intrinsic value. When maximizing shareholder wealth becomes the core financial goal, companies can create a solid foundation for ongoing growth, ensuring sustainable value creation for the investors who rely on these returns to meet their own goals.

What Determines a Company’s Value?

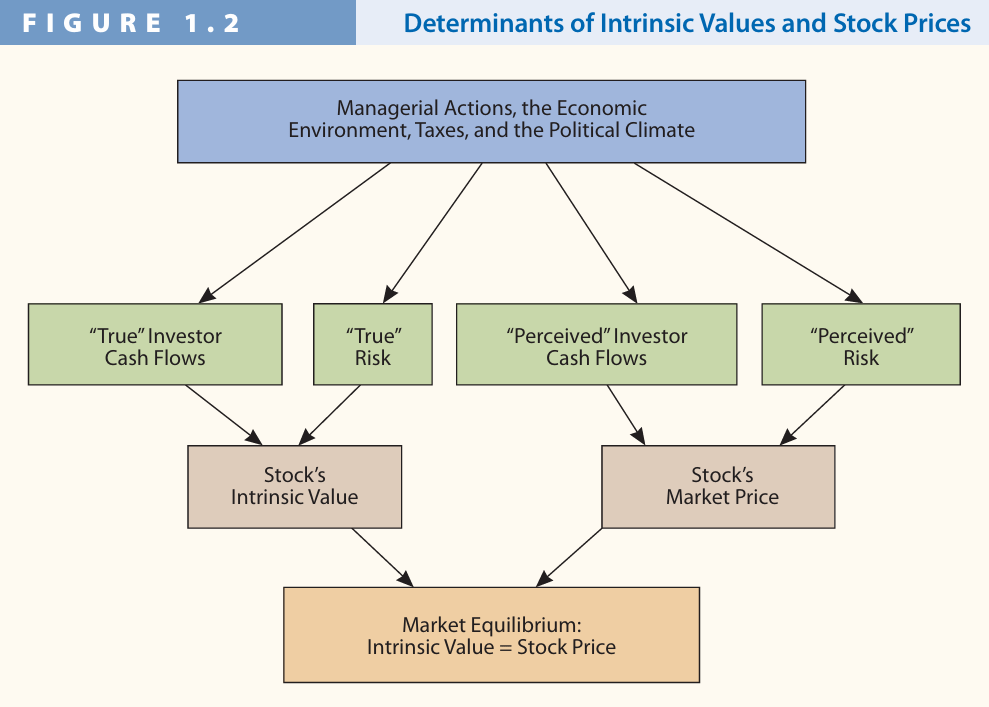

Understanding the determinants of a company’s value is essential for investors and managers who want to make informed decisions about stock investments. Figure 1.2, titled “Determinants of Intrinsic Values and Stock Prices,” breaks down the key factors that influence a company’s intrinsic value and market price. Here’s a closer look at each component:

1. Managerial Actions and External Influences: At the top of the chart, we see that a company’s value is influenced by a combination of managerial actions and external factors like the economic environment, taxes, and political climate. Together, these elements affect the company’s expected future cash flows and the risk associated with those cash flows.

When managers make strategic decisions, their actions can either increase or decrease the company’s value, depending on how they impact profitability and risk.

2. True Value vs. Perceived Value: The chart also highlights a critical difference between true value and perceived value:

True Value: This represents the cash flows and risk that investors would expect if they had complete and accurate information about the company.

Perceived Value: Investors rarely have access to perfect information, so they base their expectations on what they know or assume. This perception may differ from reality, creating a gap between true value and perceived value. For instance, in early 2001, investors perceived Enron as profitable and low-risk based on available information. However, the true situation was much riskier and less profitable, leading to a major discrepancy in stock valuation.

3. Intrinsic Value vs. Market Price: Every stock has an intrinsic value, representing its “true” worth as estimated by knowledgeable analysts with the best available financial data of a company. However, the market price of a stock is determined by the marginal investor’s perception and can vary significantly from the intrinsic value due to imperfect information and market sentiment.

This difference between intrinsic value and market price can lead to opportunities or risks, depending on how accurately investors understand the company’s true value.

4. Market Equilibrium: When a stock’s market price aligns with its intrinsic value, the stock is said to be in market equilibrium. In this state, there’s no pressure for the stock price to change. However, market prices often diverge from intrinsic values due to fluctuations in investor perception. Over time, as more information becomes available, market prices and intrinsic values tend to converge.

Understanding these factors influencing stock price allows managers and investors to make decisions that align with long-term wealth creation, even in the face of market fluctuations.

Recognizing the difference between true and perceived value helps investors identify situations where a stock might be undervalued or overvalued. For companies, focusing on actions that increase intrinsic value over the long run can ultimately lead to more stable stock prices and stronger investor confidence.

Role of Management in Maximizing Intrinsic Value

Management’s Role in Maximizing Intrinsic Value

In the world of investing, understanding the difference between intrinsic value and market price is key to making smart decisions. Intrinsic value represents a company’s “true” long-term worth, calculated through an in-depth analysis of the company’s financial health and growth potential.

Whereas, market price, which fluctuates based on short-term trends and investor sentiment, intrinsic value is a more stable measure of what a company is genuinely worth. But what role does management play in maximizing this intrinsic value?

1. Long-Term Value Creation by Management

The primary goal of a company’s management should be to maximize intrinsic value over time. By focusing on long-term value creation rather than short-term profits, management can build a stronger, more resilient company.

This approach may mean making decisions that temporarily reduce current profits in favor of greater returns in the future. For example, investing in new technologies or expanding into new markets might lower this year’s earnings, but if these actions are expected to boost future growth, they contribute positively to the intrinsic value.

2. How Management Influences Investor Perception

Management’s influence on intrinsic value doesn’t stop with internal decision-making; it also plays a crucial role in shaping investor perception.

By transparently communicating the company’s strategy and growth potential, management can help investors form a more accurate estimate of intrinsic value. This alignment between intrinsic value and market price can lead to a more stable stock price over time.

3. Balancing Short-Term Profits and Long-Term Growth

One of the biggest challenges management faces is balancing short-term performance with long-term growth.

Investors often react to immediate changes in profits, which can cause market price fluctuations even when the intrinsic value remains strong. By focusing on intrinsic value and making it clear that their goal is sustainable, long-term growth, management can guide the stock price closer to the company’s intrinsic worth.

Over time, as investors better understand the company’s true potential, the market price is more likely to align with intrinsic value, benefiting both the company and its shareholders.

Conclusion: Focusing on Intrinsic Value for Long-Term Success

For any company aiming to succeed in the public markets, understanding and focusing on intrinsic value is essential. Intrinsic value represents a stock’s true long-term worth, based on the best available data and future cash flows, while the market price reflects what investors currently perceive it to be.

In the short term, market prices may deviate from intrinsic values due to external factors, investor sentiment, and imperfect information. However, in the long run, these two values tend to converge, meaning that a company’s true worth eventually shines through. Managers should focus on actions that build intrinsic value, as this approach ultimately aligns to maximize stockholder wealth over time.

For investors, understanding the difference between intrinsic value and market price is crucial. Successful investing involves identifying situations where a stock’s intrinsic value exceeds its market price, offering an opportunity to buy undervalued assets that will, over time, approach their true value.

By emphasizing intrinsic value and staying focused on long-term financial health, companies can create sustainable wealth for their investors, achieving the primary financial goal of the corporation.

FAQ

1. What is Intrinsic value of a stock?

Intrinsic value is what a stock is actually worth based on its fundamentals—like its earnings, dividends, and growth potential. It’s the “true” value or fair price of the stock according to analysts’ and investors’ assessment of the company’s financials and future prospects.

Think of intrinsic value like the value of a car if you were to sell it today after factoring in all its qualities, such as mileage, age, and condition. Just because the car might have a high or low price on a website doesn’t change what it’s fundamentally worth.

2. What is Market Price?

The market price of a stock is the price at which it’s currently trading on the stock exchange. This price is determined by supply and demand and can fluctuate based on market sentiment, news, and investor behavior—often regardless of what the stock is fundamentally worth.

For example, say there’s a hot new product or rumor about a company’s growth. This can drive up demand and the market price, even if the company’s actual financial value hasn’t changed.

2. How do Intrinsic value and market price differ?

Imagine Company X. After analyzing its financials, an investor calculates its intrinsic value at $100 per share. However, the stock is currently trading in the market at $80 per share.

This difference shows that Company X is undervalued by the market. The intrinsic value ($100) is higher than the market price ($80), making it an attractive investment. The investor might buy shares, expecting that, over time, the market price will rise to match the intrinsic value.

Why This Matters for Investors?

If the intrinsic value of a stock is higher than the market price, it can be an opportunity to buy. If it’s lower, it might be a sign to avoid or sell the stock if already owned.