If you’ve ever wondered how investors decide whether a stock or bond is worth buying, the Security Market Line (SML) is a great concept to understand. It’s a tool used to assess the risk and return of an investment in a way that’s both simple and powerful.

Let me explain everything step by step in a conversational tone with examples so you can grasp the topic easily.

What is the Security Market Line (SML)?

The Security Market Line (SML) is a graphical representation of the Capital Asset Pricing Model (CAPM), showing the relationship between an investment’s systematic risk (beta) and its expected return. It illustrates the required return for a given level of risk, with the risk-free rate as the starting point and the market portfolio serving as the benchmark. Fairly priced securities lie on the SML, while mispriced securities fall above or below it.

Imagine you’re shopping for a new investment. You want something that rewards you fairly for the risks you’re taking. This is where the Security Market Line (SML) comes in. It’s a graph that shows the relationship between:

- Risk (how uncertain the investment is), and

- Return (how much profit you expect to make).

The SML is based on a formula called the Capital Asset Pricing Model (CAPM). Think of it as a rule book for determining how much return you deserve for taking on a certain level of risk.

How to construct a Security Market Line (SML)?

In order to construct a Security Market Line (SML), at first we will have to understand the basic elements. Let’s break down the security market line and construct a proper security market line using a hypothetical example.

Breaking Down the SML

1. The Axes of the Graph:

- The horizontal axis (X-axis) represents risk, specifically a type of risk called systematic risk, measured by beta (β).

- The vertical axis (Y-axis) represents the expected return (how much money you should make).

2. Key Components of the SML: To draw the SML, you need:

- The risk-free rate (rf): This is the return on a completely safe investment, like government bonds. Let’s say this is 6%.

- The expected return on the market portfolio E(rm): This is the average return of the entire stock market, say 14%.

- Beta (β): Always remember that, the beta of the market portfolio is always 1.

Basically, these are three basic elements we need to construct a security market line.

So, let’s construct the SML using the given information,

Now, let’s assume Square Pharmaceuticals LTD is an asset that is being traded in the market and its elements are:

- rf(risk-free rate): 6%

- E(rm)/ Expected Return on Market Portfolio: 12%

- (βm): Beta for the market portfolio is 1

- (β): Beta for Square Pharmaceuticals LTD. is 1.2

- Let’s assume the predicted and forecasted return (R^) of Square Pharmaceuticals LTD is 10%

- The expected or required rate of return of Square Pharmaceuticals LTD, E(rSPL): 13.2%

Now let’s input the information and construct a security market line first. Remember that, this security market line represents all the securities traded in the capital market.

So, we have constructed and drawn the SPL, now it’s time to input the information of Square Pharmaceuticals LTD.

So, after plotting all the information into the graph, we can see that the predicted return of Square Pharmaceuticals LTD is below the security market line and the required rate of return. So, as we can see the predicted return of Square Pharmaceuticals LTD is below the required rate of return, we can say that the asset Square Pharmaceuticals LTD is overpriced because we can already predict that, the asset’s return is showing less than the required rate of return in the market and soon the price is going to drop.

In case of overpriced or overvalued assets, rational investors refrain from buying them, and if these assets are available on an investor’s portfolio, he/she will have to sell those as soon as possible.

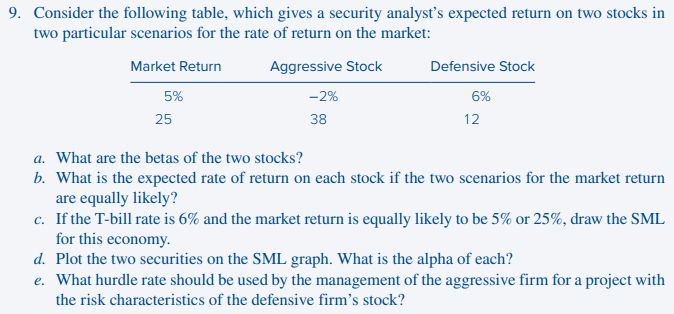

As you now know, how to construct a security market line, I can give you a question for practice purposes.

Solve this, example problem of the security market line, if you face any problem, let me know in the comment box.

Final Thoughts

The Security Market Line is like a roadmap for investing. It simplifies the complicated relationship between risk and return and gives investors a clear benchmark for evaluating assets. Whether you’re a beginner or an expert, understanding the SML can help you make smarter, more informed decisions in the market.

Remember, the SML is all about balancing risk and reward. With it, you can answer the golden question: “Am I being paid enough for the risks I’m taking?”

Feel free to share your thoughts or ask questions in the comments below!