When businesses evaluate the profitability of their investments, they often turn to the Internal Rate of Return (IRR). However, a better and more realistic measure called the Modified Internal Rate of Return (MIRR) improves the traditional IRR by addressing one of its core assumptions. This article will cover calculating the Modified Internal Rate of Return or MIRR, explain how it differs from IRR, and demonstrate the steps using a real-life business case.

Table of Contents

Before reading this article, you must understand the basics of the Internal Rate of Return (IRR).

What is the Internal Rate of Return (IRR)?

The Internal Rate of Return (IRR) is the annualized percentage return that a project or investment is expected to generate over its lifetime.

Example: If a company invests $100,000 in a project and the IRR is 15%, the project should deliver a return of 15% annually throughout its life.

Read the blog How to Calculate Internal Rate of Return (IRR) to learn how to calculate IRR.

Major Flaws of IRR

One of the major flaws of IRR is its unrealistic assumption: It assumes that all future cash flows from the project can be reinvested at the same high IRR throughout the project’s duration.

Example: If a project’s IRR is 20%, it implies that every dollar it generates will yield 20% reinvestment returns, which is often impossible due to market constraints.

What is the Modified Internal Rate of Return or MIRR?

The Modified Internal Rate of Return (MIRR) improves upon IRR by making more realistic assumptions about how cash flows will be reinvested. Instead of assuming high IRR rates, MIRR assumes that reinvestments will grow at a more achievable rate, such as the company’s Weighted Average Cost of Capital (WACC) or other market-based returns.

Why Modified Internal Rate of Return or MIRR is Better than IRR

MIRR provides a more accurate representation of a project’s profitability by:

- Realistic reinvestment rates, such as WACC, should be used instead of assuming inflated IRR rates.

- Avoiding the issue of multiple IRR values, which can arise in some projects with uneven cash flows.

- Offering a meaningful return rate that reflects financing and reinvestment scenarios more accurately.

How to Calculate Modified Internal Rate of Return (MIRR)

Let’s craft a business story to explain how to calculate the Modified Internal Rate of Return (MIRR). This will illustrate how the MIRR process works in a real-world scenario, reflecting the exact formula and approach used.

Story: “Tech Outfit’s New App Launch Investment”

Background:

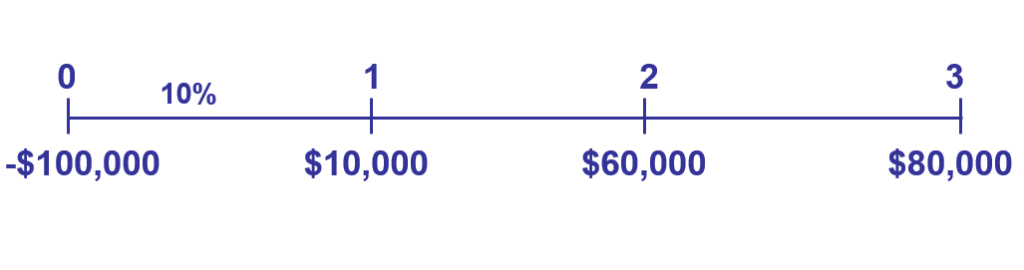

Tech Outfit, a small technology startup, is considering launching a new mobile app. The project requires an initial investment of $100,000 to cover development, marketing, and infrastructure costs. The startup expects to generate cash inflows from the app over the next three years as follows:

- Year 1: $10,000 from initial downloads and ad revenue.

- Year 2: $60,000 from subscriptions.

- Year 3: $80,000 from premium features and more subscribers.

Tech Outfit estimates a reinvestment rate of 10%, reflecting the return they could realistically achieve by reinvesting any earnings into other safe investments (like their WACC or market opportunities). The team wants to calculate the Modified Internal Rate of Return (MIRR) to decide whether to proceed with the app.

Note that this “10% reinvestment rate” is the WACC or discount rate that will be given in the case of your exam question paper.

The timeline for the project will look like this:

Step-by-Step MIRR Calculation

Tech Outfit needs $100,000 upfront to get the project started. This initial cash outflow is:

Present Value(outflows) = – 100,000

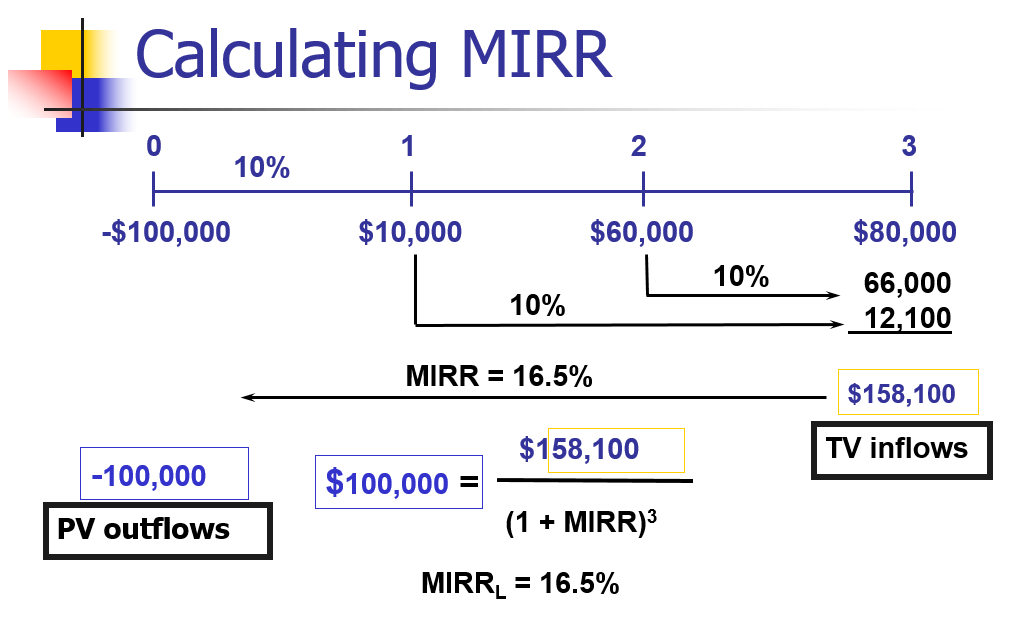

Calculating Terminal Value (TV) of Cash Inflows

Tech Outfit knows that the cash inflows over the project’s three years must be reinvested at the 10% reinvestment rate to grow. Each inflow is compounded to the end of the project (Year 3) using the following formula:

Note that this “10% reinvestment rate” is the WACC or discount rate that will be given in the case of your exam question paper.

Now, compounding the cash inflows.

Year 1 inflow:

Year 2 inflow:

Year 3 inflow:

Total Terminal Value (TV) of Inflows:

Using the MIRR Formula

Now that we have the Present Value (PV) of Outflows and the Terminal Value (TV) of Inflows, we can use the MIRR formula:

Where:

- PV = Present Value of outflows = $100,000

- TV = Terminal Value of inflows = $158,100

- n = 3 years

Rearrange the Formula to Solve for MIRR

Step-by-Step Calculation for MIRR

- Start with the MIRR equation:

$$ 100,000 = \frac{158,100}{(1 + MIRR)^3} $$

- Rearrange to isolate \( (1 + MIRR)^3 \):

$$ (1 + MIRR)^3 = \frac{158,100}{100,000} = 1.581 $$

- Take the logarithm of both sides:

$$ \log((1 + MIRR)^3) = \log(1.581) $$

- Apply the logarithmic rule \( \log(a^n) = n \cdot \log(a) \):

$$ 3 \cdot \log(1 + MIRR) = 0.19893 $$

- Solve for \( \log(1 + MIRR) \):

$$ \log(1 + MIRR) = \frac{0.19893}{3} = 0.06631 $$

- Convert back from logarithmic form:

$$ 1 + MIRR = 10^{0.06631} = 1.16496 $$

- Subtract 1 to find MIRR:

$$ MIRR = 1.16496 – 1 = 0.16496 = 16.5\% $$

So, the modified internal rate of return or MIRR is 16.5%

This equation can be solved in many ways. You can choose your suitable way.

Interpreting the Result

With an MIRR of 16.5%, Tech Outfit can confidently estimate that their app project will generate a 16.5% annual return, assuming a 10% reinvestment rate. This is a more realistic reflection of the project’s profitability than a traditional IRR calculation, which might have falsely assumed higher reinvestment rates.

This is actually how you can calculate the modified internal rate of return. Let me know in the comment box if you have any questions.

Conclusion

In investment evaluation, the Modified Internal Rate of Return (MIRR) is a more accurate, reliable, and practical alternative to the traditional IRR. While IRR often presents an inflated view of profitability by assuming reinvestment at its rate, MIRR takes a realistic approach by factoring in reinvestment at the company’s actual cost of capital (WACC) or another reasonable market rate. This makes it an essential tool for businesses and investors who want a clear, unambiguous measure of a project’s financial viability.

Using MIRR, decision-makers can eliminate confusion, avoid misleading return estimates, and gain a more transparent view of project profitability. Whether you are assessing a new business venture, a real estate project, or a corporate investment, MIRR provides the insights needed to make sound, data-driven choices.

So, the next time you evaluate an investment opportunity, ask yourself—are you making decisions based on unrealistic expectations, or are you using MIRR to get the full picture? Choosing the right metric could differentiate between a successful investment and a costly mistake.

FAQs for Modified Internal Rate of Return (MIRR)

1. What is the key difference between IRR and MIRR?

The major distinction between IRR (Internal Rate of Return) and MIRR (Modified Internal Rate of Return) lies in their reinvestment assumptions. IRR assumes that all future cash inflows from a project are reinvested at the IRR itself, often leading to overly optimistic projections. In contrast, MIRR assumes that cash inflows are reinvested at a more realistic rate, such as the Weighted Average Cost of Capital (WACC) or another market-based rate. This makes MIRR a more practical and accurate measure of a project’s profitability than IRR.

2. Why is MIRR considered more reliable than IRR?

MIRR is preferred over IRR because it eliminates some of IRR’s key flaws. One major issue with IRR is the possibility of multiple values when a project has unconventional cash flows (i.e., cash flows that switch between positive and negative values). This can create ambiguity in decision-making. Additionally, IRR often inflates project profitability by assuming reinvestment at the IRR itself, which may not be feasible in real-world scenarios. By addressing these issues and assuming a realistic reinvestment rate, MIRR provides a more consistent and reliable measure of an investment’s return.

3. How is MIRR calculated step-by-step?

The calculation of MIRR involves three main steps. First, all initial investments and outflows are discounted to determine their present value (PV). Then, future cash inflows are compounded forward at the reinvestment rate to determine their terminal value (TV) at the end of the project’s timeline. Finally, MIRR is computed using the formula.

4. What does a high or low MIRR indicate?

A high MIRR suggests that the project generates strong returns when cash inflows are reinvested at the assumed rate. This implies that the investment is attractive and potentially more profitable than alternatives. Conversely, a low MIRR indicates that the project’s returns are weaker and might not be as beneficial as other investment opportunities. If MIRR is lower than the company’s required rate of return, it may signal that the project should be reconsidered.

5. Can MIRR be negative?

Yes, MIRR can be negative under certain circumstances. The MIRR will fall below zero if a project’s cash inflows are insufficient to recover the initial investment and grow at the assumed reinvestment rate. A negative MIRR implies that the project is destroying value rather than creating it. This is a strong indication that the investment may not be viable or worth pursuing.

6. When should I use MIRR instead of IRR?

MIRR should be used instead of IRR in cases where the project has complex cash flows that result in multiple IRR values, making interpretation difficult. It is also more appropriate when decision-makers want to use a realistic reinvestment rate rather than the often unrealistic assumption of reinvesting at IRR. Additionally, if a company needs a single, clear profitability measure that accurately reflects financing and reinvestment realities, MIRR is the better choice. By eliminating the distortions caused by IRR’s reinvestment assumption, MIRR provides a clearer picture of a project’s actual profitability.