In this blog, I’ve discussed the overall theory of the Degree of Operating Leverage (DOL). By reading this blog a reader will cover the following topics

Table of Contents

- What is the Degree of Operating Leverage (DOL)?

- Why Calculate the Degree of Operating Leverage(DOL)??

- What is the importance of determining the Degree of Operating Leverage (DOL)?

- What are the Differences between Operating Leverage and Degree of Operating Leverage (DOL)?

- The process of calculating the Degree of Operating Leverage(DOL)

- Explaining the formula of Degree of Operating Leverage or DOL with an Example:

- What if you are comparing two companies and both the company’s DOLs are the same?

- Now the question is which company is better?

- Conclusion

What is the Degree of Operating Leverage (DOL)?

Degree of Operating Leverage(DOL) is a financial measure that is used to determine how sensitive the operating income (profit) of a company is to changes in its sales. It is simply the change in the operating income that will occur, given the percentage change in the sales. DOL assists us in realizing the effects of fixed and variable costs on the profitability of a company.

Why Calculate the Degree of Operating Leverage(DOL)??

We compute the level of operating leverage to know the impact of the change of sales to the operating income of a company. It informs the management and investors of the level to which the profits will rise or fall with a change in sales volume.

- Risk Assessment: It assists in identifying the risk of a business that has high fixed costs. An increased DOL implies increased risk since the profits may vary greatly with variations in sales.

- Profit Planning: It helps to make strategic choices concerning price, production, and expansion. Even firms that have high DOL should be wary during a downturn since any minor changes in sales can cause huge losses of profits.

What is the importance of determining the Degree of Operating Leverage (DOL)?

Several reasons make the DOL an important entity:

- Profit Sensitivity: It assists the companies in knowing the sensitivity of their operating income to the change in sales. This data is important in making sound business decisions.

- Controlling Fixed and Variable Costs: With the knowledge of DOL, firms can determine the extent to which they ought to raise or reduce their fixed costs to maximize profitability.

- Strategic Planning: It is an important instrument of planning the level of production, sales goals and break-even levels.

- Risk Management: The high operating leverage means that the profits are more susceptible to changes in sales thus this is very crucial information to the investors and managers in estimating the financial risk.

What are the Differences between Operating Leverage and Degree of Operating Leverage (DOL)?

Operating Leverage and Degree of Operating Leverage (DOL) are similar terms, however, they differ in a number of ways:

Operating Leverage

- Operating Leverage is the ratio of fixed costs to the overall costs in a firm.

- Explains the way a firm utilises its fixed costs to make profits.

- When a firm is operating on a high leverage, it contains a greater ratio of fixed costs and lesser variable costs. Consequently, the operating income is affected by minor shifts in sales by bigger margins.

Degree of Operating Leverage (DOL)

- The degree of Operating Leverage (DOL) determines operating income elasticity to sales

- It is a number that measures the association between the changes in sales and operating income.

- It informs you of the number of times the operating income is going to be affected by a 1 percent change in sales.

The process of calculating the Degree of Operating Leverage(DOL)

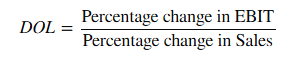

Degree of Operating Leverage Formula

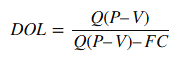

Degree of Operating Leverage Formula in terms of quantity

Or, it can be expressed in terms of quantities and costs:

Where:

- Q = Quantity of units sold

- P = Price per unit

- V = Variable cost per unit

- FC = Total fixed costs

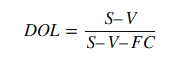

Degree of Operating Leverage Formula in terms of sales

DOL at Sales

Explaining the formula of Degree of Operating Leverage or DOL with an Example:

Let’s assume there’s a company called “TechGadgets Inc.” that sells electronic devices.

- Fixed Costs (FC): $50,000 per year (e.g., rent, salaries, etc.)

- Variable Cost per Unit (V): $20 per device (e.g., material, labor for each unit)

- Price per Unit (P): $50

- Quantity Sold (Q): 5,000 devices

First, calculate the contribution margin:

The contribution margin is the difference between the selling price of a product and its variable costs. It shows how much money is left to cover fixed costs and generate profit after covering the costs directly related to making the product.

Calculating the contribution margin

The formula for Contribution Margin is:

Substituting values:

Now, calculate the operating income

The formula for Operating Income is:

Substituting values:

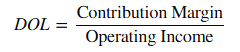

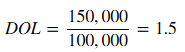

Let’s calculate the Degree of Operating Leverage (DOL)

The formula for DOL is:

Substituting values:

Interpretation: calculating the degree of operating leverage

The 1.5 value in this DOL indicates that an increase in sales by 1% results in an increase in the operating income by 1.5 times. Therefore, an increase in sales by 10% will result in an increase in the operating income of TechGadgets Inc. by (0.10x 1.5) = 0.15 or 15%.

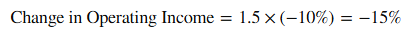

So the question now arises as to what would have happened had the sales of the company gone down by 10 percent, what will the theory of DOL say? Assuming that the company’s sales reduce by 10 percent, the Degree of Operating Leverage (DOL) will function as well in the negative such that the operating income will go down by a factor of the DOL value.

Explanation

The Degree of Operating Leverage (DOL) magnifies the positive and the negative sales changes. Therefore, assuming that DOL stands at 1.5, and the sales fall by 10 percent, then the operating income will fall by 1.5 percent in sales.

Calculation:

- Given DOL: 1.5

- Decrease in Sales: 10%

Change in Operating Income:

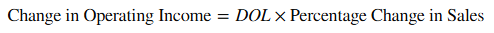

The formula for Change in Operating Income is:

Substituting values:

Interpretation:

This 1.5 DOL indicates that operating income changes by 1.5 percent of sales change every 1 percent change in sales. Therefore, the Operating Income of TechGadgets Inc. will fall by 15 percent in case sales are cut by 10 percent.

Interpreting the Results

- High DOL: A large operating leverage implies that a small increase in sales will lead to a large increase in the operating income. But the con is also true that, in case the sales are slightly lower, the operating income would be significantly lower.

- Low DOL: Low degree of operating leverage implies that the company has lower fixed costs in comparison to the variable costs; therefore, its operating income is not highly responsive to alterations in sales.

What if you are comparing two companies and both the company’s DOLs are the same?

Let’s compare two companies, Company A and Company B, to understand the Degree of Operating Leverage (DOL) and see which company might be better in different scenarios.

Scenario Overview

- Company A and Company B are both in the electronics business, selling similar products.

- They have different cost structures, which means they have different levels of fixed and variable costs.

- Let’s see how these differences impact their operating income when there is a change in sales.

Company Profiles

Company A:

- Fixed Costs: $100,000

- Variable Cost per Unit: $30

- Selling Price per Unit: $50

- Units Sold: 10,000

- Sales Revenue: $500,000

Company B:

- Fixed Costs: $50,000

- Variable Cost per Unit: $40

- Selling Price per Unit: $50

- Units Sold: 10,000

- Sales Revenue: $500,000

If you calculate both the company’s Degree of Operating Leverage (DOL), both the company’s DOL will be 2.0. It’s your time to calculate and find out if I’m right or wrong.

Now, let’s say the sales increase by 10%

If sales increase by 10%:

- Company A’s Operating Income will increase by 20% (10% × 2.0 = 20%).

- Company B’s Operating Income will increase by 20%.

If sales decrease by 10%:

- Company A’s Operating Income will decrease by 20%.

- Company B’s Operating Income will decrease by 20%.

Now the question is which company is better?

Comparison Criteria:

- Stability and Risk:

- Company A has higher fixed costs ($100,000) compared to Company B ($50,000).

- This means that Company A is riskier because its profits are more sensitive to sales changes.

- If sales fall drastically, Company A will suffer more due to its higher fixed costs.

2. Flexibility

- Company B has a higher variable cost but lower fixed costs.

- This means it can better handle downturns in sales because it does not have to cover as high a fixed cost every month.

Summing up,

- If sales are expected to grow steadily, Company A is better because it will generate higher operating income due to its lower variable costs.

If there is uncertainty or a risk of sales decreasing, Company B is better because it has lower fixed costs and can maintain profitability more easily when sales drop.

Watch a video on Degree of Operating Leverage (DOL)

Also, learn about Financial Leverage and the Degree of Financial Leverage for more knowledge.

Conclusion

The Degree of Operating Leverage, in short, is a measure of the sensitivity of your profit to changes in sales. The greater the DOL the more leveraged your earnings are and this is that the profits could change significantly with a slight change in sales volume.

Hopefully, this example will help to understand the concept better! You can ask me if you have any particular questions or want to go further on one of the points.