In this article, I’m going to write about the current assets investment policies that every company has to adopt in its operational activities.

In financial management, the way a company handles its current assets—cash, marketable securities, receivables, and inventories—significantly impacts its profitability and risk profile. The decision to allocate resources among these assets determines the firm’s liquidity, turnover ratios, and ultimately, its return on equity (ROE).

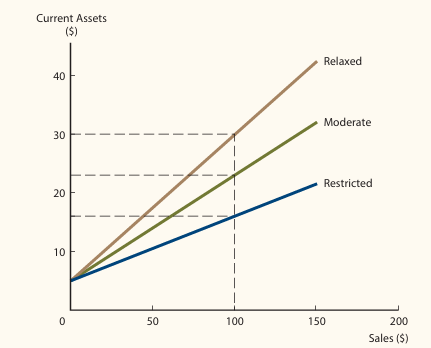

Broadly speaking, companies can adopt one of three types of current asset investment policies: relaxed, moderate, or restricted. Each policy has unique characteristics and implications for profitability and risk.

Understanding Current Assets and Their Importance

Current assets are assets that are expected to be converted into cash within a year. These assets include cash and cash equivalents, marketable securities, accounts receivable, and inventory. Companies need to manage these assets carefully to maintain operational efficiency, meet financial obligations, and optimize profitability. However, the optimal level of current assets can vary based on the company’s strategy, industry, and market conditions.

For instance, a retailer may require a larger inventory than a service provider, and a firm in a volatile market may hold more cash than one in a stable environment. The right policy on current assets ensures smooth operations while balancing profitability and risk.

Let’s explore the three primary current assets investment policies for managing current assets.

1. Relaxed Investment Policy

A relaxed investment policy involves holding relatively large amounts of current assets, including cash, marketable securities, and inventories. Companies that adopt this approach tend to have liberal credit policies, which result in high accounts receivable. This strategy offers several advantages and disadvantages:

Characteristics of relaxed investment policy and its Impact on ROE

- High Liquidity: A relaxed policy ensures ample liquidity, reducing the risk of cash shortages. This buffer can be crucial for companies in industries with unpredictable cash flows or lengthy production cycles.

- Lower Asset Turnover: Due to the large holdings in current assets, the total assets turnover ratio tends to be low. This means that while the company is safeguarded against liquidity issues, it may not be utilizing its assets as efficiently as possible.

- Lower ROE: In a relaxed investment policy, the company holds more current assets like cash, inventory, and receivables. This means it has more “extra” resources on hand, but these assets aren’t directly generating sales or profit. As a result, asset turnover (how efficiently the assets generate sales) is lower.

In short, keeping too many current assets can make a company less efficient at generating sales, which impacts overall profitability (ROE).

Example of a relaxed investment policy

Consider a manufacturing firm that opts for a relaxed investment policy. This firm holds high levels of raw materials and finished goods to avoid any interruptions in production and meet customer demand instantly. Additionally, it offers generous credit terms to its customers, leading to higher accounts receivable.

While this approach minimizes the risk of stockouts and enhances customer satisfaction, it results in lower turnover ratios and profitability due to the capital tied up in inventories and receivables.

2. Restricted Investment Policy

On the opposite end of the spectrum is the restricted investment policy, or “lean-and-mean,” investment policy. Companies following this approach maintain minimal levels of current assets. They hold just enough cash, inventory, and receivables to support their operations, aiming to maximize asset turnover and, consequently, ROE. However, this policy also introduces a level of operational risk.

Characteristics of restricted investment policy and its Impact on ROE

- Operational Vulnerability: Due to tight control over inventories and cash reserves, firms may face production delays, work stoppages, or missed sales opportunities if unexpected events occur.

- High Asset Turnover: If you have understood the characteristics of relaxed investment policy you’ll understand this as well. With limited current assets, the restricted policy ensures a high total assets turnover ratio. Higher turnover indicates efficient use of assets and often correlates with a higher ROE, given that the firm generates more sales per dollar of assets.

- Higher ROE but Increased Risk: The restricted approach enhances ROE by maximizing the asset turnover component. However, it exposes the company to the risk of liquidity crises, stockouts, and customer dissatisfaction.

Example of a restricted investment policy

A technology startup with limited capital may follow a restricted investment policy. By holding minimal inventory and offering limited credit to customers, the company keeps cash flow tight but maximizes its asset utilization.

However, this policy risks running out of essential parts or missing customer orders, potentially damaging its reputation in the long run.

3. Moderate Investment Policy

As the name suggests, the moderate investment policy is mostly used among all the current assets investment policies that strike a balance between relaxed investment policy and a restricted investment policy. Companies following this policy maintain a level of current assets that minimizes both the liquidity risk and the inefficiency associated with excess holdings.

Characteristics of moderate investment policy and its Impact on ROE

- Balanced Asset Turnover: A moderate investment policy achieves a balanced turnover ratio, yielding a more stable and often satisfactory ROE. By optimizing asset levels, companies avoid extreme capital tying without exposing themselves to liquidity issues.

- Lower Risk, Steady Profitability: The moderate approach mitigates the risks associated with both the relaxed and restricted policies. It offers a compromise, allowing firms to have enough resources to handle unexpected events while ensuring efficiency in asset utilization.

- Adaptable to Changing Conditions: Firms using a moderate investment policy can adjust more flexibly to changes in the market or internal operations. This adaptability often aligns with a firm’s long-term goals of maintaining stable growth and intrinsic stock value.

Example of a moderate investment policy

Consider a retail company that adopts a moderate policy for managing its inventories and receivables. The company maintains adequate stock to meet regular customer demand but leverages a just-in-time inventory management system to minimize holding costs. It also offers standard credit terms to customers with good credit ratings, keeping receivables at a manageable level. This approach enables the company to operate efficiently, maintain customer satisfaction, and achieve steady profitability.

Choosing the Right Policy: Weighing Profitability and Risk

The optimal current assets investment policy for any firm depends on its industry, business model, and financial goals. For instance, companies in fast-moving industries such as retail often benefit from a moderate policy, as they need to balance inventory levels with seasonal demand fluctuations. In contrast, firms with long production cycles, like aerospace manufacturers, may lean towards a relaxed policy to ensure they can meet production requirements.

The right policy must also consider the firm’s tolerance for risk and its return objectives. A relaxed policy may be suitable for risk-averse companies seeking stability over profitability. On the other hand, companies focused on maximizing ROE and willing to accept higher risk might choose a restricted policy.

Evolving Factors in Current Assets Management

Technological advancements continuously reshape optimal asset management strategies. Innovations like inventory tracking, automated reordering systems, and financial analytics have enabled firms to optimize their working capital more precisely.

For example, barcoding and inventory management software allow retailers to minimize “safety stocks” by tracking each product’s status in real-time. This reduces the need for high inventory levels and aligns with a more restricted investment policy or moderate investment policy without compromising service quality.

Additionally, financial technologies (FinTech) provide businesses with faster access to working capital, reducing the need for large cash reserves. A company that can access cash quickly through short-term loans or other financing options may feel comfortable adopting a leaner, restricted investment policy.

Conclusion

In conclusion, selecting an appropriate policy among all the current assets investment policies is crucial for any company aiming to balance profitability and risk effectively. The relaxed investment policy provides ample liquidity and minimizes operational risks but at the cost of lower ROE.

The restricted policy maximizes ROE by enhancing asset turnover but introduces significant risks, potentially impacting customer satisfaction and production continuity. A moderate policy offers a balanced approach, making it a suitable choice for firms seeking a stable yet efficient use of assets.

Ultimately, the choice of policy should align with the firm’s long-term objectives and risk tolerance. Regularly evaluating and adjusting the chosen policy in response to changing market conditions, technological advancements, and financial requirements can help companies optimize their working capital management, ensuring sustainable growth and maximizing shareholder value.