In today’s complex financial world, managing risk is crucial for both lenders and borrowers. Credit risk analysis is a fundamental process for financial institutions, businesses, and individuals seeking to understand the potential risk involved in lending or borrowing. In simple terms, credit risk is the possibility that a borrower will fail to meet their financial obligations—such as repaying a loan, bond, or credit card debt—on time or at all.

But how exactly do financial professionals assess and manage credit risk? In this article, we’ll dive into the concept of credit risk, explore the methods used to measure it, and provide you with clear examples to make the topic easier to understand.

What is Credit Risk?

At its core, credit risk is the risk that a borrower may fail to fulfill their financial obligations. This can involve anything from missed loan repayments to defaulting on bonds or credit card debt. Credit risk is inherent in all lending activities, whether it’s a personal loan, a business loan, or a bond investment.

For instance, if a bank lends money to a person or a business, the bank faces the risk that the borrower may not be able to repay the debt. If the borrower defaults, the lender incurs a financial loss. The risk increases if the borrower has a poor financial history or unstable income.

The Importance of Credit Risk Analysis

Credit risk analysis helps lenders evaluate whether lending to a particular borrower is a good decision or not. The goal is to predict the likelihood of default and adjust the terms of the loan, such as the interest rate or the collateral required, accordingly.

For example:

- A high-risk borrower may be charged a higher interest rate or asked to provide more collateral to offset the risk.

- A low-risk borrower, on the other hand, may receive a lower interest rate because they are considered more likely to repay the loan without any issues.

Credit risk analysis is also essential for businesses. A business that understands the credit risk of its customers or potential partners can make better financial decisions and avoid costly defaults.

Key Methods for Measuring Credit Risk

There are various techniques to measure credit risk, ranging from simple financial ratios to complex models that combine multiple data points. Below are some of the most common methods used in credit risk analysis:

1. Credit Scoring Models

Credit scoring is the most widely used method for assessing credit risk, particularly for individual borrowers. Credit scoring models evaluate a borrower’s creditworthiness based on factors like income, credit history, debt levels, and repayment history. This method assigns a credit score to the borrower, which reflects their likelihood of defaulting on the loan.

- High Credit Score (e.g., 750 and above): Indicates a low credit risk.

- Low Credit Score (e.g., 600 or below): Indicates high credit risk.

For example, consider two individuals applying for a loan:

- Person B has a credit score of 580, multiple missed payments, and a high level of existing debt. This individual poses a higher risk to lenders.

- Person A has a credit score of 800, a steady income, and a history of paying bills on time. This individual poses a low risk to lenders.

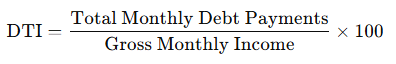

2. Debt-to-Income (DTI) Ratio

The Debt-to-Income (DTI) ratio compares a borrower’s total monthly debt payments to their gross monthly income. A higher DTI ratio indicates that a borrower is using a larger portion of their income to pay off debt, which can make it harder for them to meet future financial obligations.

The formula for calculating DTI is:

For example:

- Person A has a DTI ratio of 30%, indicating they can manage additional debt without much risk.

- Person B has a DTI ratio of 80%, indicating they are already overburdened with debt, which makes them a high-risk borrower.

A high DTI ratio signals higher credit risk because it suggests the borrower has limited ability to repay new debt.

3. Financial Ratios

Financial ratios are another vital tool in assessing the credit risk of businesses. By analyzing key ratios, lenders can determine whether a company has the financial stability to repay a loan.

Common financial ratios include:

- Debt-to-Equity Ratio: This ratio compares the company’s debt to its equity. A higher ratio indicates that the company is more leveraged, which means higher risk for the lender.

- Interest Coverage Ratio: This measures the company’s ability to meet its interest obligations with its earnings. A higher ratio is considered lower risk, as it indicates the company can comfortably pay interest on its debt.

Example:

- If a company’s debt-to-equity ratio is 0.5, this indicates it has moderate debt compared to its equity, and therefore a moderate risk.

- However, if the ratio is 3.0, it indicates that the company is heavily leveraged, making it a high-risk borrower.

4. Credit Default Swaps (CDS)

For larger loans and more complex financial transactions, Credit Default Swaps (CDS) are used as a form of insurance against credit risk. A CDS is a financial derivative where the lender buys protection against a borrower defaulting. If the borrower defaults, the CDS seller compensates the lender for the loss.

By using CDS, financial institutions can manage credit risk by transferring some of the potential losses to another party. This is particularly useful in corporate bonds and other large loans where the default risk is significant.

5. Linear Probability Models and Logit Models

When analyzing credit risk, financial institutions often use statistical models to estimate the probability of default. These models use past borrower data (e.g., repayment behavior, financial ratios) to calculate the likelihood that a borrower will default in the future.

- Linear Probability Models (LPM): These models predict the probability of default using linear regression. However, they can sometimes produce probabilities outside the range of 0 and 1, which makes them less reliable.

- Example: If a company’s debt-to-equity ratio is 0.6 and the sales-to-assets ratio is 1.8, the model might predict a default probability of 41%, indicating moderate risk.

- Logit Models: To overcome the limitations of LPM, Logit models use a logistic function to transform the predicted probabilities so that they always lie between 0 and 1, making them more reliable for assessing credit risk.

6. Credit Risk Mitigation Strategies

While credit risk can never be fully eliminated, there are ways to mitigate it:

- Thorough Credit Checks: Always perform detailed credit checks on borrowers before approving loans.

- Secured Loans: Lenders can request collateral to secure loans. In case of default, the lender can seize the collateral to recover their losses.

- Loan Diversification: Avoid concentrating loans in one borrower or industry to reduce the impact of defaults.

- Use of Credit Derivatives: Credit default swaps (CDS) can hedge against the risk of borrower defaults.

Conclusion

In the world of finance, credit risk analysis is essential for making informed lending decisions and minimizing financial losses. By using tools like credit scores, debt-to-income ratios, and advanced models like Linear Probability Models and Logit models, financial institutions can better assess a borrower’s likelihood of default. While credit risk cannot be fully eliminated, a strong understanding of how to measure and manage it is crucial for both lenders and borrowers alike.

Whether you’re seeking a loan or evaluating a borrower’s credit risk, understanding these methods can help you make better financial decisions and protect yourself against potential defaults.