If you’re new to options trading or looking to safeguard your investments, the protective put is one of the most important strategies you must understand. In this beginner-friendly guide, we’ll cover everything you need to know: what a protective put is, how it works, why it’s used, and how to apply it in real-world scenarios. The put protection strategy in option provides essential protection against market downturns.

We’ll also include examples, equations, and a fun story to tie it together.

What is a Protective Put?

A protective put is an options trading strategy used by investors who own an asset (such as stocks) and want to protect themselves from potential losses. It’s like buying insurance for your investment. By purchasing a put option alongside your stock position, you set a safety net that ensures you won’t lose more than a specific amount, no matter how far the stock price drops.

By employing a protective put, investors can effectively create a safety net that minimizes their potential losses while still allowing for upside gains. The protective put is not just a defensive tactic; it’s an essential component of a well-rounded investment strategy.

How It Works:

- You own the stock (this is called a “long position”).

- You buy a put option on the same stock.

- The put option gives you the right to sell the stock at a specific price (called the strike price) before the option expires.

In addition, utilizing a protective put strategy allows for greater peace of mind, enabling investors to focus on their long-term goals without the constant worry of market volatility.

By doing this, you set a minimum value for your portfolio, ensuring that no matter how far the stock price falls, your losses are capped.

Definition of a Put Option

A put option is a contract that gives the buyer the right (but not the obligation) to sell an asset at a predetermined price (called the strike price) before the option expires.

Key Features of a Protective Put:

- You own the underlying stock and buy a put option for the same stock.

- The put option guarantees a minimum selling price (the strike price) for the stock.

- It limits your losses but still allows you to profit if the stock price rises.

Origins of the Protective Put

Understanding the protective put strategy is crucial for anyone looking to navigate the complexities of the investment landscape effectively.

Options have been around for centuries, with records dating back to Ancient Greece when philosophers like Thales speculated on olive presses. However, modern options markets emerged in the 1970s with the establishment of the Chicago Board Options Exchange (CBOE).

The protective put strategy evolved as a tool for investors to manage risk in volatile markets. By combining ownership of an asset with a put option, investors gained a way to “insure” their portfolios against downside risks while retaining upside potential.

How Does a Protective Put Work?

In summary, the protective put serves as a vital tool for risk management, allowing investors to protect their assets while still capitalizing on potential market upside.

The protective put works by using the put option’s strike price as a “floor” for the value of your investment. Even if the stock price falls, the put option ensures you can sell your shares at the strike price, preventing further losses.

Let’s break it down step by step.

Step 1: Buying the Stock

First, you own the stock (the “long position”). For example:

- You buy one share of IBM stock at S0 = $100.

Step 2: Purchasing the Put Option

Next, you buy a put option for the same stock with:

- Strike price (X) = $100 (the price at which you can sell the stock).

- Premium (P) = $10 (the cost of the put option).

Step 3: Holding Until Expiration

At expiration, the stock price (ST) can do one of three things:

- Stock Price Falls Below Strike Price (ST<X):

- Example: ST = $80.

- You exercise the put option and sell the stock for X = $100, avoiding further losses.

- Portfolio Value = $100 – $10 (premium) = $90.

- Stock Price Equals Strike Price (ST=XS):

- Example: ST = $100.

- The put option expires worthless, but your stock retains its value.

- Portfolio Value = $100 – $10 (premium) = $90.

- Stock Price Rises Above Strike Price (ST>XS):

- Example: ST = $120.

- The put option expires worthless, and you sell the stock for the higher market price.

- Portfolio Value = $120 – $10 (premium) = $110.

Protected put Equations

Understanding the math behind the protective put is essential for grasping its mechanics. Here are the key equations:

Understanding the Protective Put with Equations

The protective put can be understood with simple equations that calculate your portfolio value and profit/loss:

1. Portfolio Value:

Where:

- \( S_T \) = Stock price at expiration,

- \( X \) = Strike price of the put,

- \( P \) = Premium paid for the put option.

2. Profit/Loss:

Where: \( S_0 \) is the initial stock price.

Example Calculation:

Let \( S_0 = 100, X = 100, P = 10 \):

- If \( S_T = 80 \):

Graphical Explanation of Put Protection Strategy

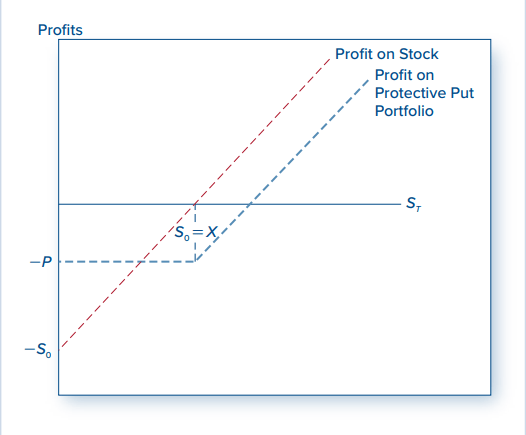

This is a graphical representation of the profit-and-loss profile for a protective put strategy compared to a stock-only investment. It demonstrates how the protective put offers downside protection while limiting your losses to a known amount. Let’s break it down in detail.

By integrating a protective put into your investment strategy, you can significantly enhance your ability to weather market fluctuations.

Graph Breakdown

Key Elements:

- Red Line (Profit on Stock):

- Represents the profit or loss from holding only the stock without any protection.

- Unlimited upside potential: As the stock price (ST) rises, profits increase indefinitely.

- Unlimited downside risk: As ST falls below the initial price (S0), losses grow dollar-for-dollar.

- Blue Dashed Line (Profit on Protective Put Portfolio):

- Represents the profit or loss when you combine a stock with a put option (the protective put strategy).

- Downside protection: Losses are capped at −P (the cost of the put option premium), regardless of how far the stock price falls.

- Reduced upside: Gains are reduced by the premium (P) paid for the put option, but profits still grow as ST increases.

- Strike Price (X):

- The horizontal point where the put option becomes relevant. Below this price, the put option compensates for the stock’s losses.

- Break-even Point:

- Occurs when the stock price rises enough to cover the premium cost. This is at ST = S0+P.

Scenario: Using a Protective Put Example with IBM Stock

Let’s apply a scenario to the graph:

Inputs:

- Initial stock price (S0) = $100.

- Strike price (X) = $100.

- Premium (P) = $10.

Outcomes at Expiration:

Let’s analyze different stock prices at expiration (ST):

Case 1: Stock Price Falls to $80 (ST<X)

- Stock-only investment (Red Line):

- Loss = ST−S0 = 80−100 = − 20.

- Protective put portfolio (Blue Dashed Line):

- The put option compensates for the stock’s loss:

- Put payoff = X−ST = 100−80 = 20.

- Total profit = Stock loss + Put payoff – Premium:

Profit = −20 +20 −10 = −10

- The put option compensates for the stock’s loss:

- Result: Loss is capped at $10, the cost of the put premium

Case 2: Stock Price Stays at $100 (ST=XS)

- Stock-only investment (Red Line):

- Profit = ST−S0 = 100 −100 = 0

- Protective put portfolio (Blue Dashed Line):

- The put option expires worthless, and you lose the premium:

Profit = 0−10 = −10

- The put option expires worthless, and you lose the premium:

- Result: You break even on the stock but lose the premium cost ($10).

Case 3: Stock Price Rises to $120 (ST>XS)

- Stock-only investment (Red Line):

- Profit = ST−S0 = 120 − 100 = 20

- Protective put portfolio (Blue Dashed Line):

- The put option expires worthless, and your profit is reduced by the premium:

Profit = 20 −10 = 10

- The put option expires worthless, and your profit is reduced by the premium:

- Result: You still profit, but gains are slightly reduced due to the premium.

Results and Insights

- Downside Protection:

- The protective put ensures that losses are capped at −P = −10

- Even if the stock price falls to $0, you don’t lose more than the premium.

- Upside Potential:

- The stock’s upside remains intact, though gains are reduced by the premium cost (P).

- Break-even Point:

- The break-even stock price is:

ST = S0+P = 100+10 = 110 - At ST=110, you fully recover the premium and start making net gains.

- The break-even stock price is:

- Comparison to Stock-Only Investment:

- The red line shows that a stock-only investor faces unlimited losses as the stock price drops.

- The blue dashed line demonstrates how the protective put caps losses, offering peace of mind during market downturns.

Why Use This Option Strategy?

- Risk Management: It’s perfect for investors who want to reduce exposure to large losses while maintaining growth potential.

- Volatility Protection: Ideal during uncertain or volatile markets.

- Psychological Comfort: Reduces anxiety by ensuring a safety net for your investments.

A Fun Story: Insurance for Your Investments

Imagine Sarah, a professional photographer, buys a $1000 camera for her work. She knows accidents happen, so she buys 100 dollars in insurance for the camera. Now:

- If the camera is damaged, the insurance company reimburses her 1000 dollars, ensuring she doesn’t lose her investment.

- If nothing happens, she only loses the $100 insurance cost.

This is exactly how a protective put works:

- The camera is your stock.

- The insurance is the put option.

- The premium is the cost of the put option.

Sarah has peace of mind knowing she’s protected, just like an investor using a protective put.

Conclusion

The protective put is an invaluable strategy for investors looking to protect their portfolios while maintaining the profit potential. By combining stock ownership with a put option, you can limit your losses without giving up the opportunity for gains.

FAQs

1. What is a protective put option strategy?

A protective put is an options trading strategy where an investor:

- Owns the underlying stock (a long position).

- Buys a put option on the same stock.

This strategy acts as insurance for the stock, ensuring that losses are limited if the stock price falls. It allows the investor to benefit from potential upside gains while capping downside risk.

A protective put is used to:

2. Why use a protective put option strategy?

- Limit losses: It guarantees a minimum portfolio value, no matter how far the stock price drops.

- Manage risk: Ideal for volatile or uncertain markets.

- Preserve upside potential: Unlike selling the stock, it allows you to keep your position and benefit from price increases.

3. When to buy a protective put?

You should consider buying a protective put in the following situations:

- Market uncertainty: When you expect significant market volatility.

- Downside risk concerns: When you’re worried about a potential price drop in your stock.

- Earnings announcements: Before events that could cause sharp price movements, such as earnings reports or news announcements.

- Portfolio insurance: If you want to protect your gains after a stock has risen significantly.

4. What is meant by protective put?

A protective put refers to the combination of:

- Owning a stock (long position).

- Buying a put option to protect against downside risk.

It’s called “protective” because it shields your investment from large losses, similar to an insurance policy.

5. What is a synthetic protective put?

A synthetic protective put mimics the payoff structure of a protective put using other financial instruments. Instead of owning the stock and buying a put, you:

- Buy a call option.

- Short sell a futures or stock contract.

This approach achieves the same risk/reward profile as a protective put but uses derivatives exclusively.

6. What does a protective put do?

A protective put:

- Limits losses: Ensures that your portfolio value won’t fall below a certain level (strike price minus premium).

- Retains upside potential: Lets you profit if the stock price rises above the strike price.

- Provides flexibility: You can exit your stock position or hold it until market conditions improve.

7. What does a protective put strategy involve?

The protective put strategy involves:

- Owning the stock: You maintain a long position in the underlying stock.

- Buying a put option: You purchase a put option with a strike price close to the current stock price.

- Combining the two: The put option acts as a safety net, capping losses while leaving upside potential intact.

8. What is a protective put call?

The term protective put call may confuse some, but it likely refers to either:

- The call option aspect of the synthetic protective put strategy (buying a call and shorting a stock).

- Mislabeling of the put option is used in a protective put strategy.

In a protective put, only the put option is used alongside stock ownership.

Ultimately, mastering the protective put strategy is key to achieving sustainable success in the world of options trading.

Additional FAQs

9. How does a protective put differ from selling the stock?

Selling the stock locks in your current gains or losses, whereas a protective put allows you to retain ownership and benefit from future price increases while limiting downside risk.

10. How much does a protective put cost?

The cost of a protective put is the premium of the put option. This premium depends on:

- The strike price: Higher strike prices cost more.

- The time to expiration: Longer durations cost more.

- Market volatility: Higher volatility increases premiums.

11. What is the break-even point in a protective put strategy?

The break-even point is the stock price at which your total profit/loss equals zero. It is calculated as:

Break-even Point = S0+P

Where:

- S0 = Initial stock price.

- PP = Put option premium.

12. What are the advantages of a protective put?

- Limits downside risk: Losses are capped.

- Keeps upside potential: You can still profit from stock price increases.

- Flexibility: Protects your portfolio without selling the stock.

13. What are the disadvantages of a protective put?

- Premium cost: The put option premium reduces your overall profit.

- Time decay: The put option loses value as expiration approaches, especially if the stock price stays above the strike price.

14. Can a protective put strategy be used on any stock?

Yes, a protective put can be used on any stock as long as there are actively traded put options available for that stock. It is most effective for stocks with:

- High volatility.

- Uncertainty surrounding future price movements.

15. What is the maximum loss in a protective put strategy?

The maximum loss is limited to:

Maximum Loss = P

This is the cost of the put option premium, assuming the stock price drops significantly below the strike price.

16. Can I sell the put option before expiration in a protective put strategy?

Yes, you can sell the put option before expiration if its value increases (e.g., due to a stock price drop or increased volatility). This flexibility allows you to manage your position based on changing market conditions.